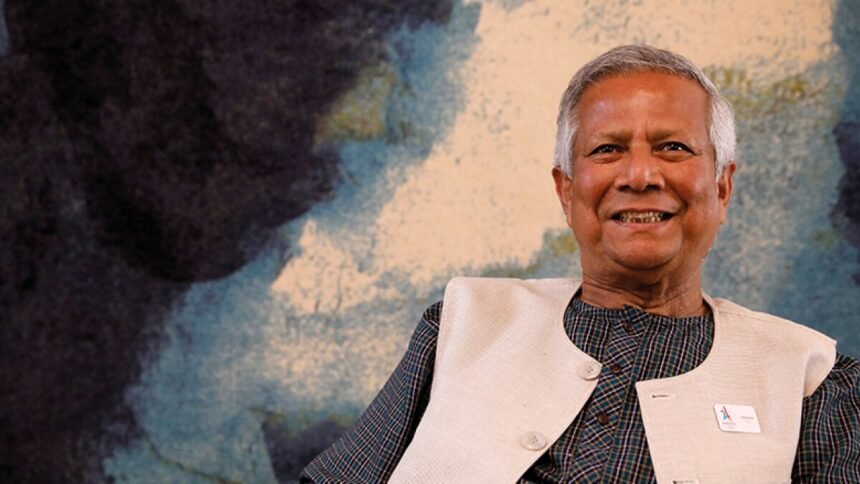

Muhammad Yunus, the 83-year-old Nobel laureate hailed as the “banker to the poorest of the poor,” has been a global icon for his pioneering work in microfinance. Founder of the Grameen Bank, he has empowered millions of rural women in Bangladesh by providing small cash loans, catalyzing economic growth and inspiring similar initiatives worldwide.

In 2006, Yunus was awarded the Nobel Peace Prize for his groundbreaking approach to poverty alleviation. The Grameen Bank’s model involved extending microcredit to impoverished individuals, particularly women, enabling them to invest in essential tools and equipment for agriculture or small businesses. This grassroots approach aimed to break the cycle of poverty by fostering entrepreneurship and financial independence.

Grameen Bank’s success story became a symbol of hope for countless communities, not only in Bangladesh but across the globe. The microfinance model was adopted by numerous developing countries, reflecting its potential to uplift the socio-economic status of marginalized populations.

About Muhammad Yunus:

However, despite international acclaim, Yunus faced challenges on his home turf. In recent years, he found himself entangled in legal controversies, leading to his imprisonment. This development cast a shadow on the celebrated figure’s legacy within Bangladesh.

The tension stemmed from a clash with powerful adversaries who viewed Yunus’s influence and the Grameen Bank’s success as a threat. The microfinance pioneer’s commitment to empowering the impoverished clashed with vested interests, leading to a complex narrative of admiration and opposition.

While the global community lauds Yunus for his contribution to poverty alleviation and economic empowerment, the domestic discord highlights the challenges faced by visionaries striving to create positive change within their own countries. The dichotomy between international recognition and local resistance underscores the delicate balance between progress and resistance to change.

Muhammad Yunus’s story is not only one of triumph but also a reminder of the hurdles faced by those who challenge the status quo in their quest for social and economic justice. Despite the adversity, Yunus’s legacy endures as a testament to the transformative power of microfinance and the enduring impact it can have on communities worldwide.