In its upcoming second bi-monthly monetary policy for FY24, the Reserve Bank of India (RBI) is anticipated to keep the repo rate unchanged, focusing on assessing the impact of the recent rate hike cycle. The current policy repo rate stands at 6.50%. Experts believe that a rate cut is unlikely at this juncture due to various factors affecting the economy.

Indranil Pan, Chief Economist at Yes Bank, points out that the evolving growth-inflation mix suggests the RBI will continue its pause in June. The central bank had already held rates steady in April, intending to convey that the decision should not be interpreted as a significant policy shift.

The recent release of India’s fourth-quarter FY23 GDP numbers showed better-than-expected growth at 6.1%, while headline consumer price index (CPI) inflation eased to 4.7% in April, marking the second consecutive month below the RBI’s upper tolerance limit of 6%. However, price pressures persist, as indicated by an 8.1% month-on-month increase in vegetable prices for May. The reduction in CPI can be attributed partly to the high base effect from the previous year.

Considering these factors, experts suggest that the RBI will maintain the repo rate due to several reasons. Firstly, the recent interest rate hikes, which have cumulatively amounted to 250 basis points since May of the previous year, are still percolating through the economy and influencing demand. Secondly, a hawkish stance by the US Federal Reserve and expectations of continued increases in policy interest rates in advanced economies contribute to the cautious approach of the RBI.

Furthermore, the prevailing scenario characterized by global commodity price volatility, financial market fluctuations, supply chain constraints, and monsoon prospects in India adds to the uncertainty. The impact of the monsoon on agricultural output, rural demand, and overall inflation trajectory is crucial for the RBI’s decision-making process.

Deepak Sood, Secretary General of ASSOCHAM, expects the RBI to maintain the existing repo rate of 6.5%, considering the factors mentioned above. He emphasizes that the stance of the RBI regarding future trajectory and its assessment of global banking and financial risks, the health of Indian banks, and the emerging new financial architecture will be closely watched.

While the experts believe that a rate cut is not expected in the immediate future, there is a consensus that the next move by the RBI will likely be a reduction. However, the timing for such a cut may not occur until around the February 2024 Monetary Policy Committee meeting.

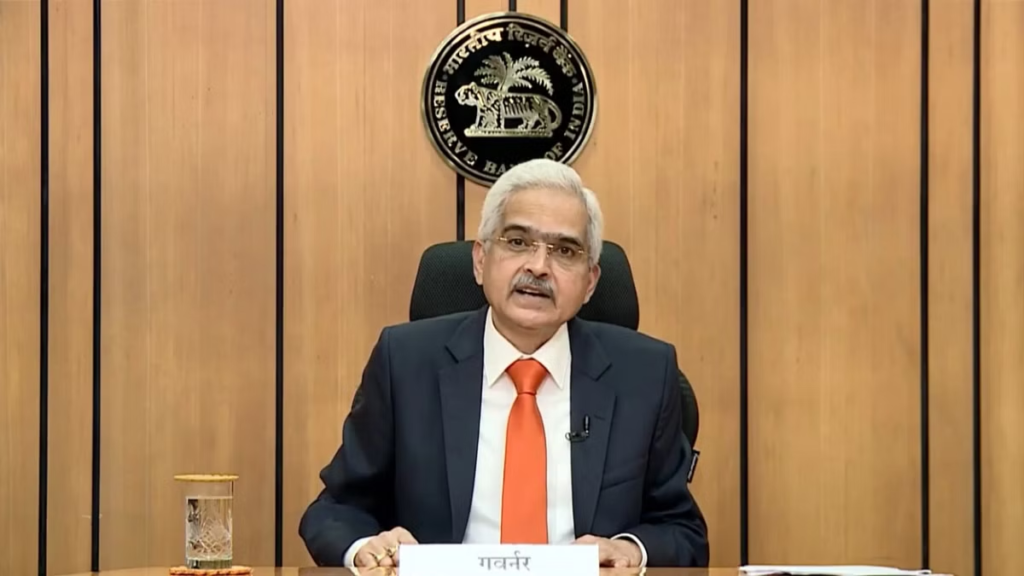

In conclusion, Governor Shaktikanta Das and the RBI are expected to keep the repo rate unchanged in the second bi-monthly monetary policy for FY24. The cautious approach is driven by the need to assess the impact of recent rate hikes, persistent price pressures, global economic conditions, and the monsoon’s effect on the overall inflation trajectory. As the Indian economy shows signs of stabilisation, the market will keenly observe the RBI’s stance and commentary on the evolving financial landscape and potential risks.